Portuguese Real Estate Market

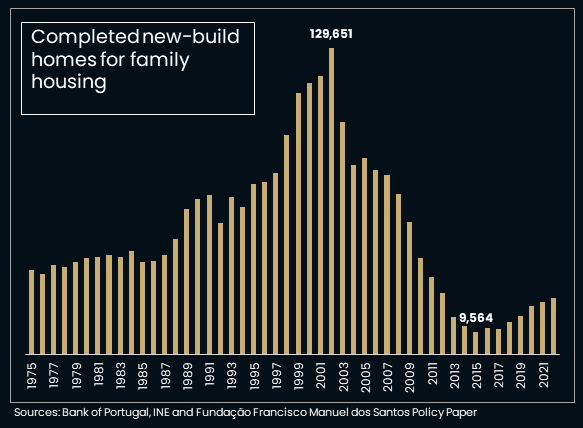

According to INE, between 2013 and 2022, around 150.000 new units were built, which contrasts with around 630.000 dwellings in the previous decade.

- This sharp slowdown in construction, transversal to all regions and partly the result of a focus on the more time-consuming, complex but necessary process of urban regeneration, was also the result of various constraints, namely greater financial restrictions on the construction sector and the probable scars still existing from the financial crisis, which resulted in a loss of installed capacity in the sector.

- As the graph on the right confirms, the housing stock shows a certain ageing dynamics, with greater rehabilitation and less new construction

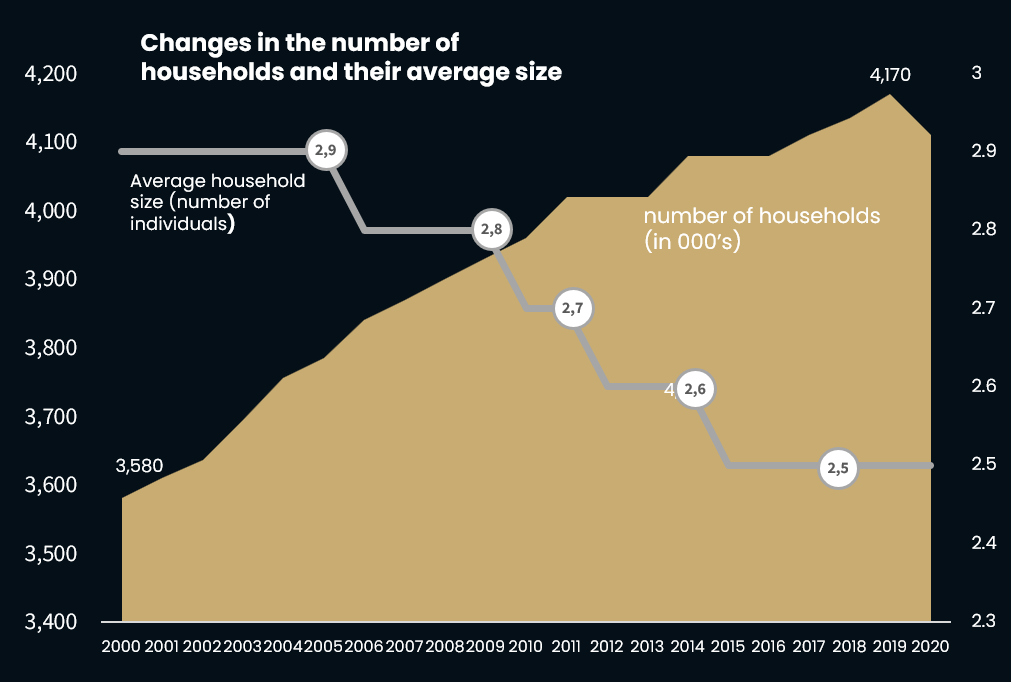

Today there are more households, but smaller ones

- Today there are more one-person households, couples without children and single-parent families, with a 14 per cent drop in the average number of people per household since the beginning of the century.

- Furthermore, despite the national population loss observed in the Census between 2011 and 2021, the situation at local level is very varied, with the population of the Lisbon metropolitan area increasing by 1,7 % and that of the Porto metropolitan area decreasing by 1,3%.

- Taken together, all these factors meant an increase in demand and, possibly, an increased friction in the market, due to the recomposition of existing demand.

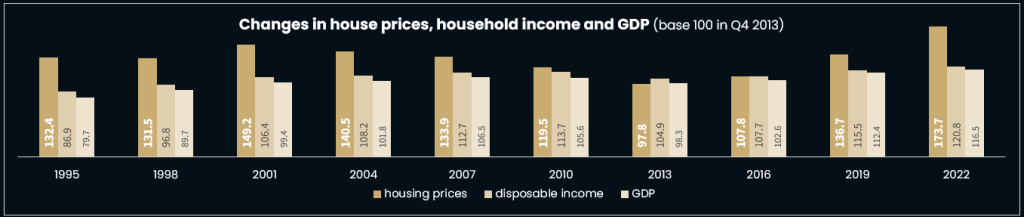

Recent house price developments in Portugal is the result of pressure from demand and the low

supply of new units

Recent house price developments in Portugal is the result of pressure from demand and the low supply of new units

- Housing demand has experienced significant growth and significant growth and changes, particularly in particularly in Lisbon and Porto, which have increased friction and put pressure on prices. The evolution of housing prices has contributed to the acceleration of inequality in many countries, including Portugal, where increase in housing prices has outstripped wage increases. These developments also affects the rental market, one of the main sources of income for property investors and one of the main monthly expenses for tenants.

- The rise in house prices since 2017 in Portugal has led to a deterioration in the accessibility of the housing market, both in terms of buying and rental, especially in the metropolitan areas of Lisbon and Porto.

Sources: Confidencial Imobiliario, INE and Fundação Francisco Manuel dos Santos Policy Paper